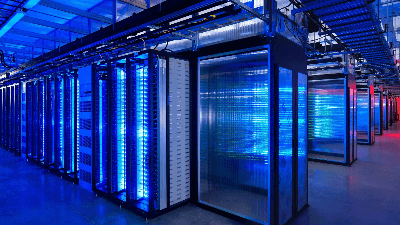

The U.S. Air Force, through the Department of the Air Force(DAF), is launching an ambitious leasing program aimed at partnering with private industry to build and operate commercial-scale AI data centers on military installations. The move reflects the Pentagon’s broader push to accelerate AI computing capacity and leverage federal real-estate assets for strategic technology infrastructure.

What the Solicitation Says

On October 15, 2025, the Air Force published a notice thatit is seeking proposals from qualified commercial entities to leas under-utilized parcels of land on five Air Force installations.

The targeted bases include:

Arnold Air Force Base, Tennessee

Edwards Air Force Base, California

Joint Base McGuire-Dix-Lakehurst, New Jersey0

Davis-Monthan Air Force Base, Arizona

Robins Air Force Base, Georgia

The leases areexpected to run up to 50 years. The parcels vary in size, in some cases covering hundreds of acres, depending on thebase. The Air Force emphasizes that utilities (power, water) must be secured and provided by the lessee at its own cost, and that proposals must minimize and mitigate impact and risk to DAF missions, government functions, and the surrounding community.

While the Air Force will not provide direct funding for the project, the aim is to leverage private-sector investment and market

efficiencies.

Why This Matters

1. AI & computing demand — AI workloads require massiveinfrastructure: high-performance computing, energy, cooling, and data-center footprint. The DAF notes that “AI is transforming the modern world, and these data centers are crucial for America to remain at the forefront of innovation.”

2. Strategic federal land use — The DAF is tappingunder-utilized parcels of federally owned land to accelerate deployment rather than wait for slower internal procurement or build processes.

3. Mission fit & resilience — By placing these datacenters on military installations, the Air Force may better integrate them into strategic infrastructure, potentially enhancing resilience, connectivity, and security. However, any proposal must ensure no negative impact on installation energy or water resilience.

4. Commercial-public partnership model — This is not atypical government-funded build by the Air Force, but rather a leasing model to draw in private operators who bring capital, expertise, and potentially innovation. It reflects a broader shift in infrastructure financing and development.

Key Considerations and Risks

Utility demands — Data centers can consume huge quantitiesof power and water. Local utility capacity and community impact are real risks, and the Air Force emphasizes that lessees must plan and pay for these utilities without jeopardizing installation or community infrastructure.

Community concerns — Data center projects have previouslysparked local opposition due to their utility usage and environmental footprint.

Selection and timeline — The Air Force expects to selectapplicants early in 2026 and may expand leasing opportunities beyond the initial five bases.

Permit and regulatory landscape — Though the initiativelinks to executive orders aimed at accelerating federal permitting for data-center infrastructure, successful deployment still depends on state and local regulations, grid access, cooling, and connectivity.

Security and mission alignment — Hosting commercial AI datacenters on military installations brings additional layers of security, classification, and compatibility with mission requirements. Proposals must ensure they do not interfere with the base’s mission.

What’s Next for Interested Companies

For companies considering responding to the solicitation,some practical steps and observations:

Review the full Request for Lease Proposal (RFLP) andassociated notice of intent to understand scope, timeline, requirements, and eligibility.

Evaluate on-site conditions: acreage, connection toutilities, available infrastructure, environmental constraints, base security and access, and compatibility with the base mission.

Develop a business model: evaluate capital investment,long-term lease structure, utility and energy sourcing, cooling strategy, data connectivity, redundancy, and sustainability.

Engage with base leadership and local communities:successful data center projects often require coordination beyond the lease — grid upgrades, permitting, environmental review, and community relations.

Prepare for competitive selection: The Air Force will weighnot only financial value but also how proposals address energy and water impacts, community relations, mission support, and resilience.

Broader Context

This initiative should be seen in the broader context ofU.S. defense and infrastructure policy. The industrial and logistics base and tech ecosystem are under increasing pressure to support AI, cloud, high-performance computing, and data-centric military operations.

The siting of large-scale data centers on federal land,including military installations, is part of a push to control geo-strategically critical infrastructure and derive value from existing government assets. This model of lease-to-commercial partnership aligns with other federal efforts to attract private investment into infrastructure that might otherwise require full federal funding.

Conclusion

The Air Force’s leasing initiative for AI data centers onunder-utilized base land is a significant step in aligning military real estate strategy with the demands of an AI-driven future. By offering long-term leases at five major installations, the DAF is signaling openness to public-private partnership, heavy-duty infrastructure investment, and rapid deployment of critical computing capacity.

For companies in the data-center, hyperscale, orinfrastructure space, the opportunity is compelling—but comes with material demands in terms of investment, utility planning, community engagement, and mission compatibility.

Companies that move early, present credible utility andenergy plans, show readiness to integrate with base operations, and deliver real value could be well-positioned in what may become a larger wave of similar opportunities at other military sites.